Although the U.S. equity markets showed further signs of weakness to end the third quarter, the USD was unable to muster any strength today following four positive days in a row.

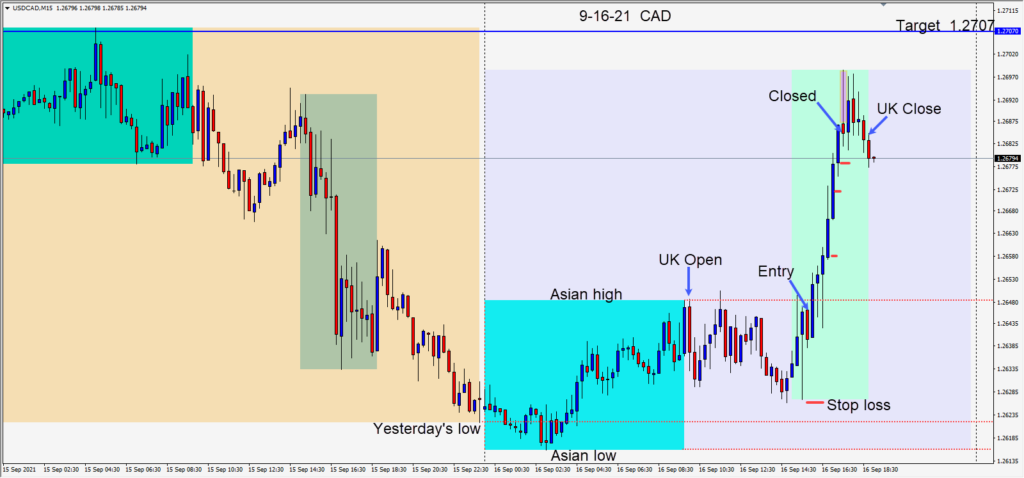

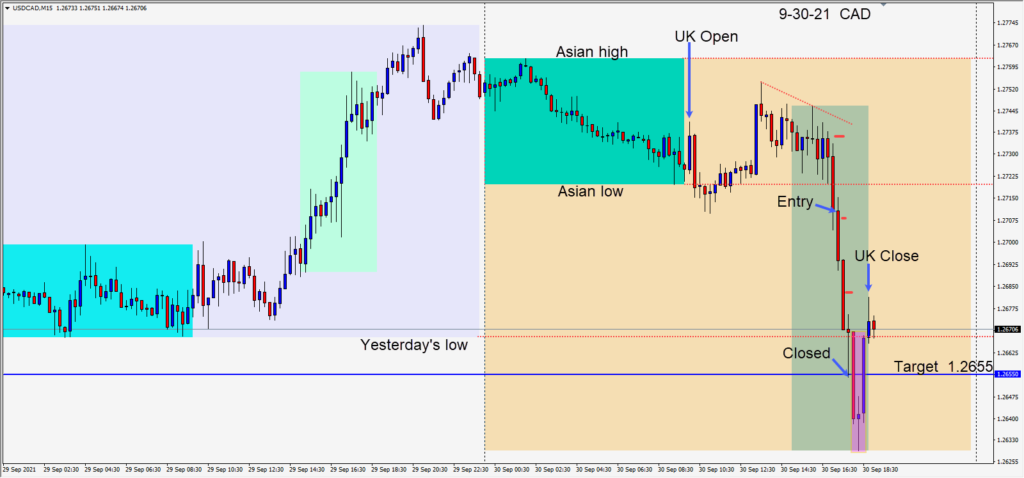

Once the USDCAD broke its Asian session low early in the U.S. session, a short was taken risking 23 pips for a potential 55 pips to our daily target at 1.2655. Price accelerated lower and our trade was closed at our target three candles later. Price continued lower for two more candles without us and formed a reversal pattern going into the U.K. close.

Friday is a holiday for China and Hong Kong. Europe, Britain, Canada and the U.S.A. all have potentially high volatility economic releases to be aware of tomorrow.

Good luck with your trading!