The Federal Reserve statement on Wednesday resulted in further USD weakness and this carried through today as the DXY moved below 92.00.

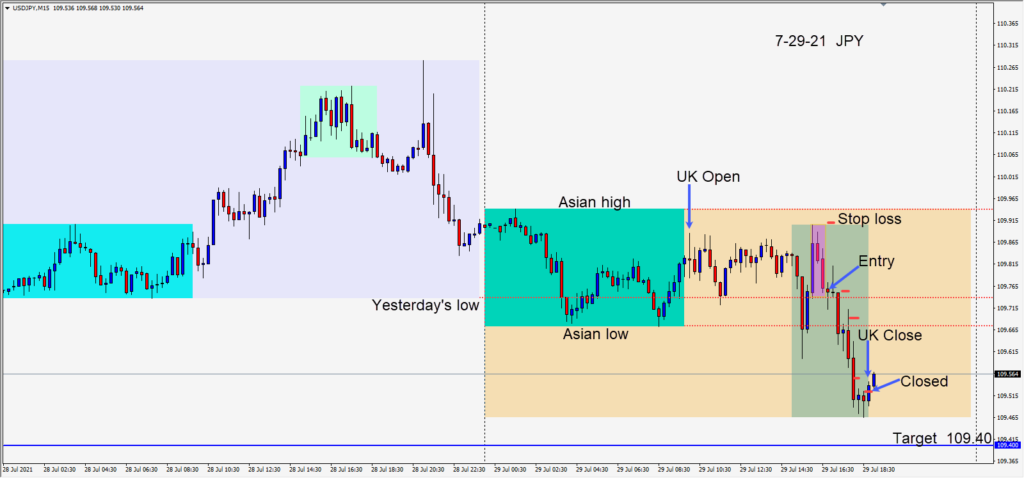

As the USDJPY came off its New York high, a short was taken risking 15 pips for a potential 36 pips to our daily target at 109.40. The pair moved lower testing briefly its Asian session low before moving down to 104.50 where it failed to close below, as the U.K. session came to a close. With long lower wicks forming as the U.K. close approached, we tightened our profit stop and the trade was closed.

Friday will be a busy day for economic releases for Europe, Canada and the U.S.A. Be careful of volatility near the release times.

Good luck with your trading!