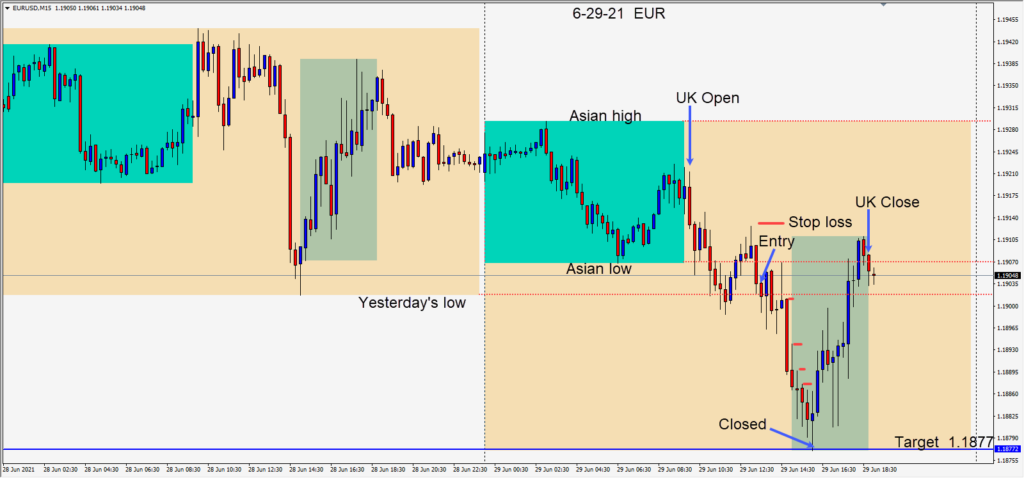

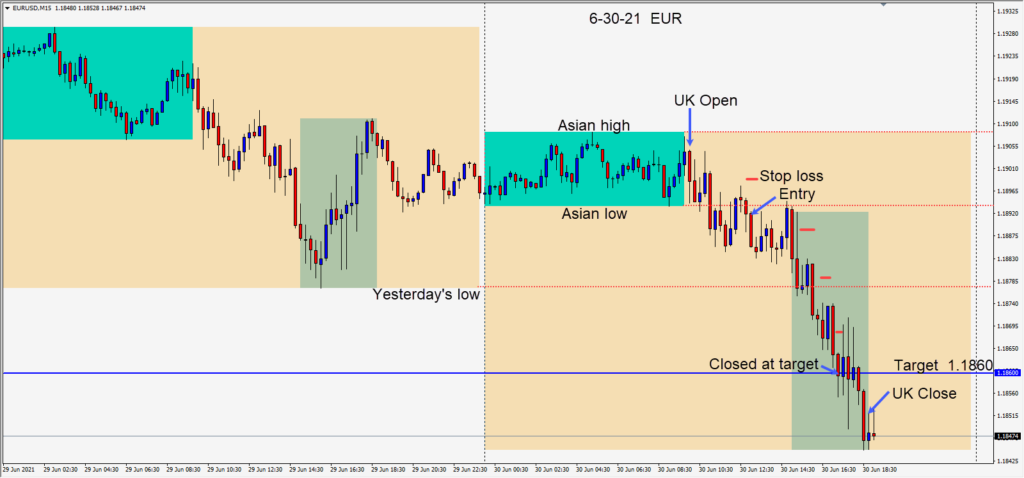

This trade was very similar to yesterday’s trade.

Price moved lower early in the U.K. session luring in breakout traders. We waited for it to pull back and move lower again before going short… risking 8 pips for a potential 31 pips to our daily target at 1.1860. Price moved lower after our entry but pulled back making a third lower high at the beginning of the U.S. session. The pair then moved down to our target where we exited the trade as USD strength continued today.

The pair could test 1.1800 and even 1.1700 in the coming weeks. Ranges continue to be subdued currently.

Tomorrow is a holiday in Canada, followed by NFP on Friday and a holiday in the U.S. on Monday.

Good luck with your trading!