A bit of back and forth price action as the markets prepare for the FOMC and month end.

The DXY continues to be on its back foot… bearish below 91.00.

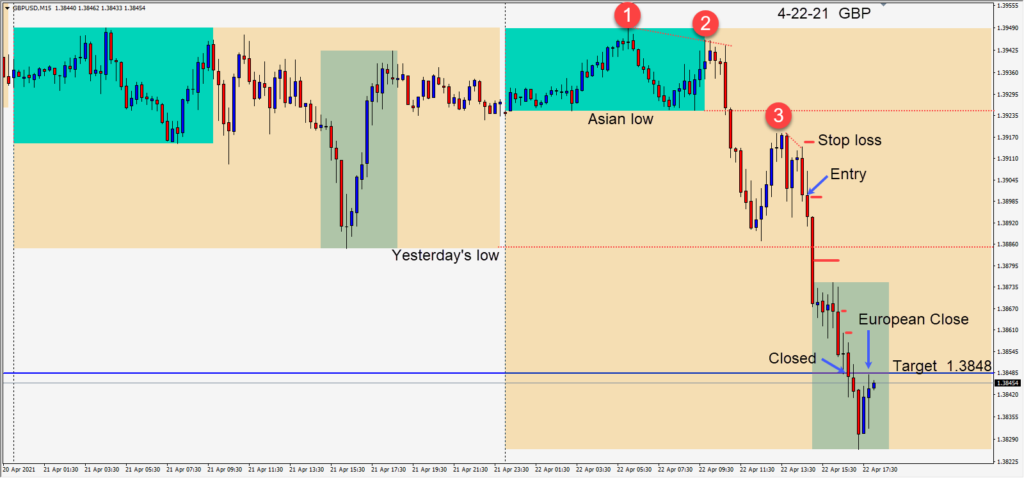

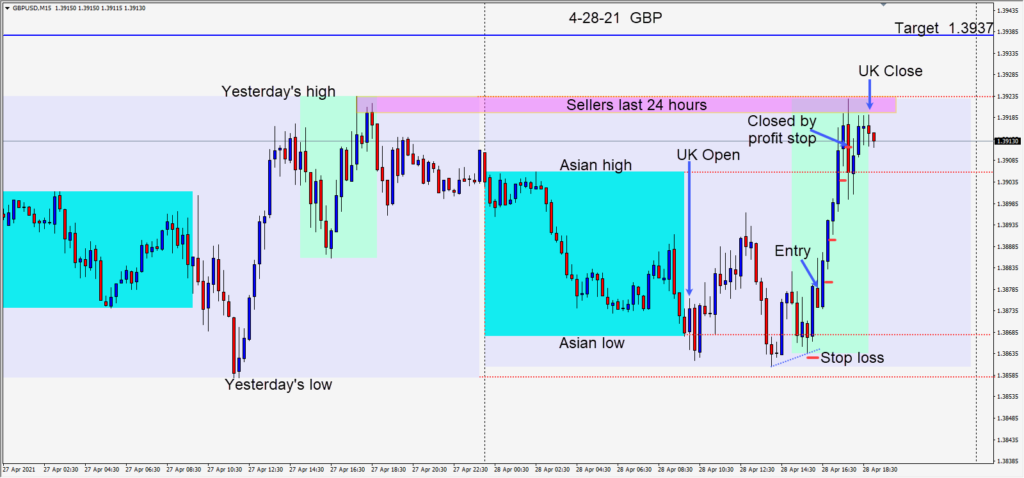

A long GBPUSD was taken early in the U.S. session after a higher low as price moved up into its Asian range – risking 17 pips for a potential 58 pips to our daily target at 1.3937. We locked in profit as the trade continued upward. Price cleared its Asian high but ran into sellers near yesterday’s high and our trade was closed.

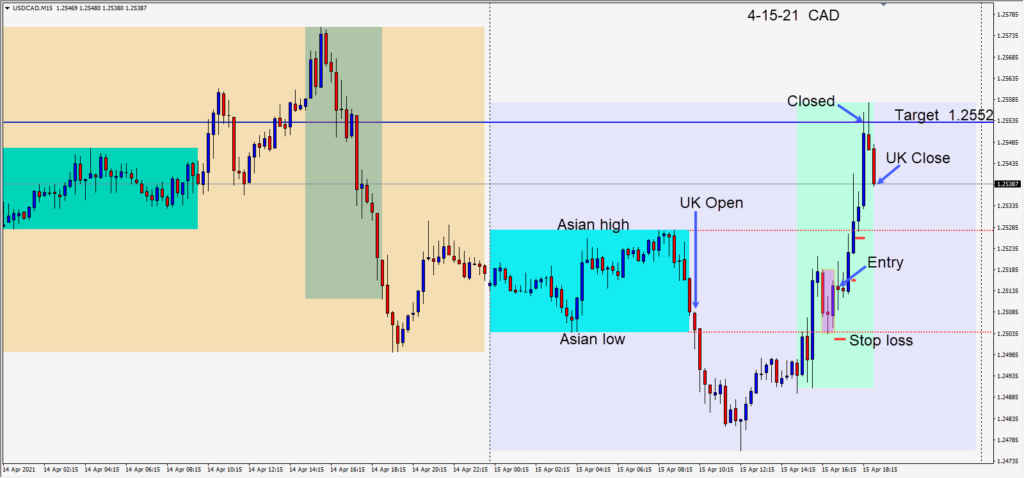

The USDCAD was another great trade setup today.

It’s interesting currently seeing U.S. equities selling as quarterly earnings reporting continues. The USD however has not benefitted and neither have bonds.

Good luck with your trading!