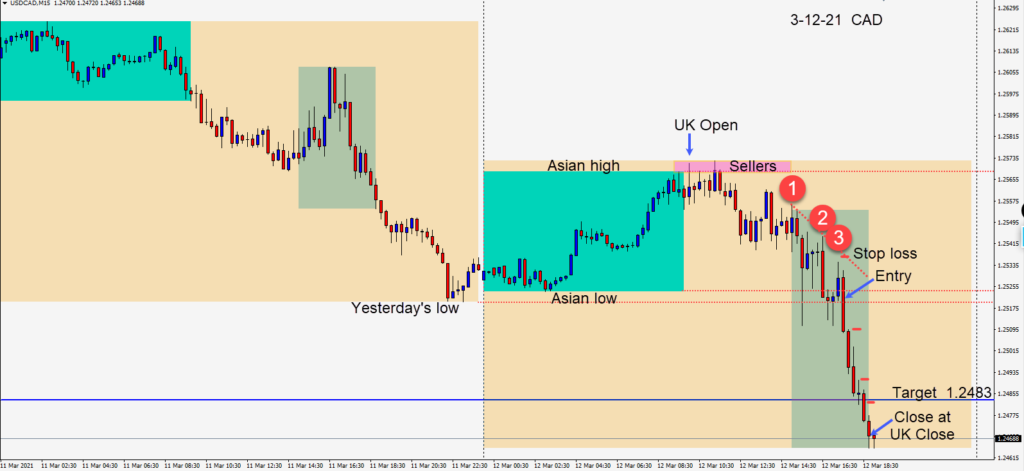

As commodities continue to rise at this stage of the economic growth story, traders can look for setups in the CAD, AUD and NZD pairs. With oil performing very well this year and 70 percent of Canadian exports going to the U.S., the USDCAD has been very active as the U.S. economy recovers.

Today after the positive employment economic release for Canada, the pair set up with a third lower high in the U.S. session overlap. A short entry as price moved beneath the previous bullish candle approaching yesterday’s low required a stop loss of 15 pips for a potential 37 to our daily target at 1.2483.

Price continued lower as it had since testing its Asian session high early in the U.K. session. Price had already been lower than yesterday’s low three times since the U.S. open and moved down to test these lows again for any buyers. It then moved down to test the 1.2500 figure. Our daily target was reached and price moved lower still going into the U.K. close.

The 1.2500 figure is a big psychological number to penetrate, so a retest next week is very possible.

The markets remains choppy as traders contemplate the impact of rising bond yields versus buoyant equity markets and vaccine availability worldwide.

Good luck with your trading, stay healthy and enjoy your weekend!