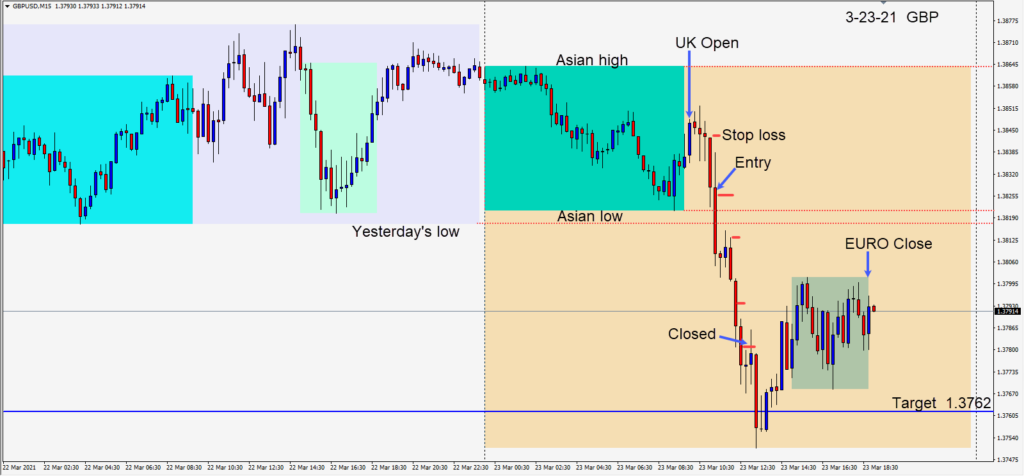

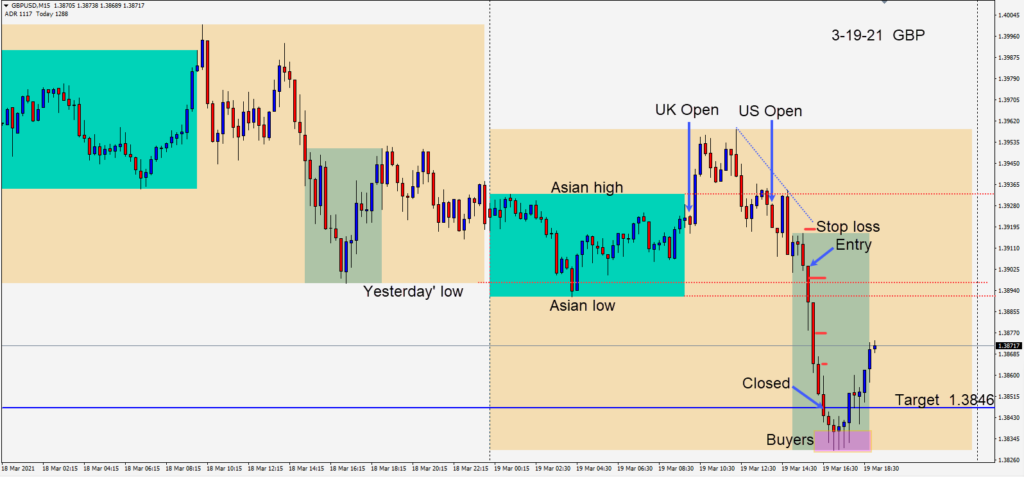

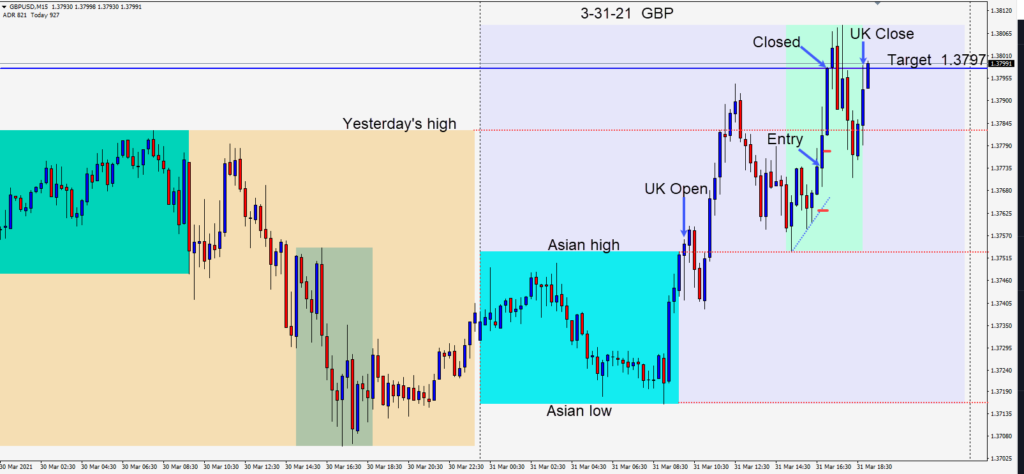

The GBPUSD moved lower going into the U.S. session overlap. As the pair began to move higher, coupled with a weaker USD today, a long was taken risking 10 pips for a potential 24 pips to our daily target at 1.3797. The first candle after our entry produced a long upper wick, so we moved our stop loss to a profit stop level just above our entry. Price moved higher to our target where we exited the trade just below the 1.3800 figure.

We found a couple of other trades today including a USDCAD short and a EURGBP short.

GBP levels to currently watch:

Above 1.3800, 1.3821, 1.3847, 1.3871

Below 1.3800, 1.3779, 1.3756, 1.3742, 1.3733, 1.3693

Good luck with your trading!