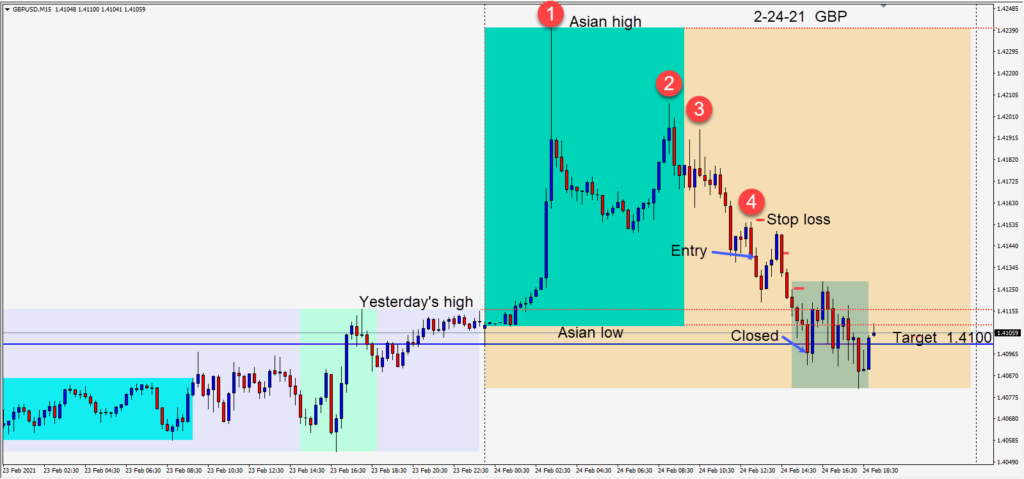

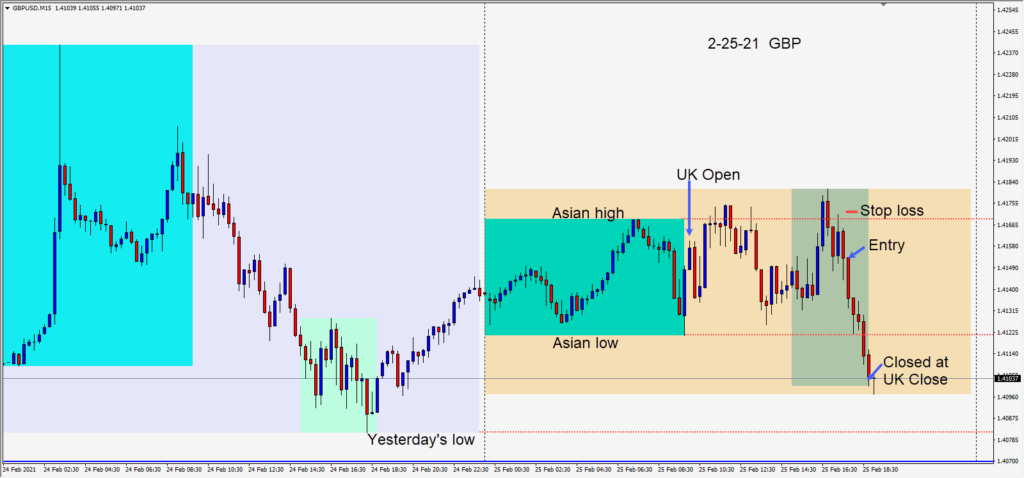

The GBPUSD could not sustain above its Asian session highs today. After the U.S. economic releases, the pair appeared to be rolling over and moving lower. This was despite the USD being weak today. Correlations were not very useful but a risk of 19 pips for a potential 83 pips to our daily target at 1.4069 was very attractive, so a small position was taken.

Price continued lower and we closed the trade well short of our daily target at the close of the U.K. session. If price can continue lower and get beneath our target, then it may test the mid figure 1.4050 level for buyers, but expect a bounce at 1.4000 as GBP bulls take advantage of the pullback.

Good luck with your trading!