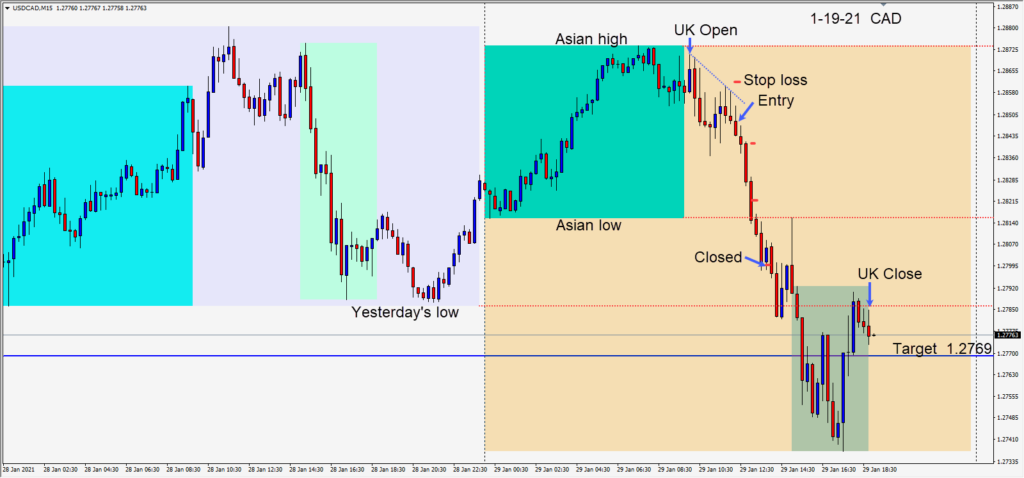

This pair typically trades well during the North American session because it’s the currencies of two trading partners in the same time zones.

Today the pair set up nicely for a short two hours into the U.K. session… requiring risk of 14 pips for a potential 79 pips to our daily target at 1.2769.

Price began to move lower and the first level to get through was the Asian session low, then the 1.2800 figure, yesterday’s low and on down to our daily target.

With numerous economic news releases for the U.S. and Canada today, when the pair paused at the 1.2800 figure, we exited to avoid any news related volatility.

Enjoy your weekend, stay healthy and good luck with your trading!