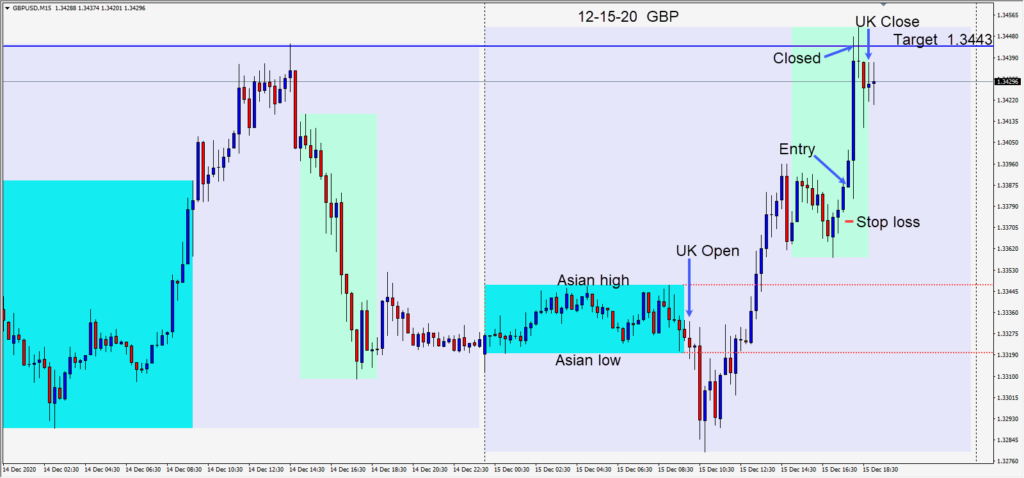

The currency markets are known to be volatile and during the final days of the ongoing saga of Brexit negotiations, the GBPUSD is extremely volatile. Be careful above 1.3500.

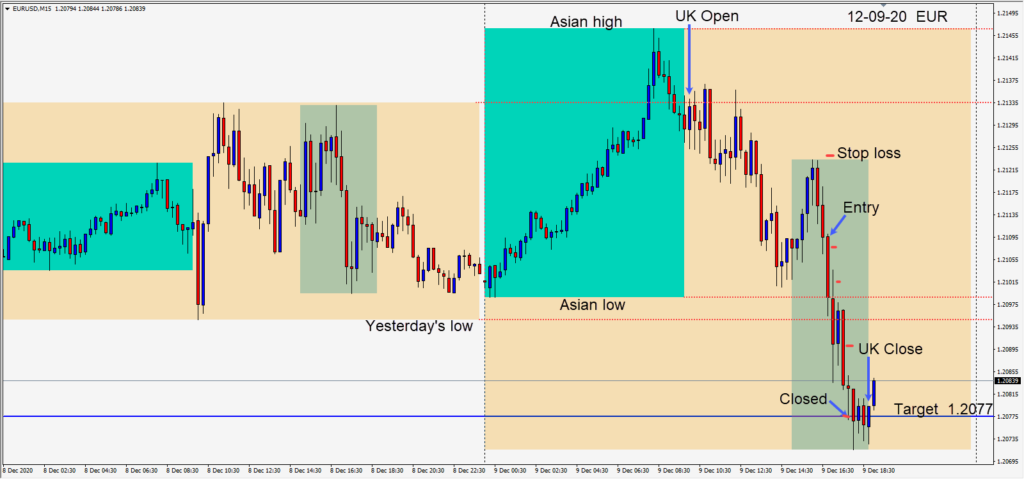

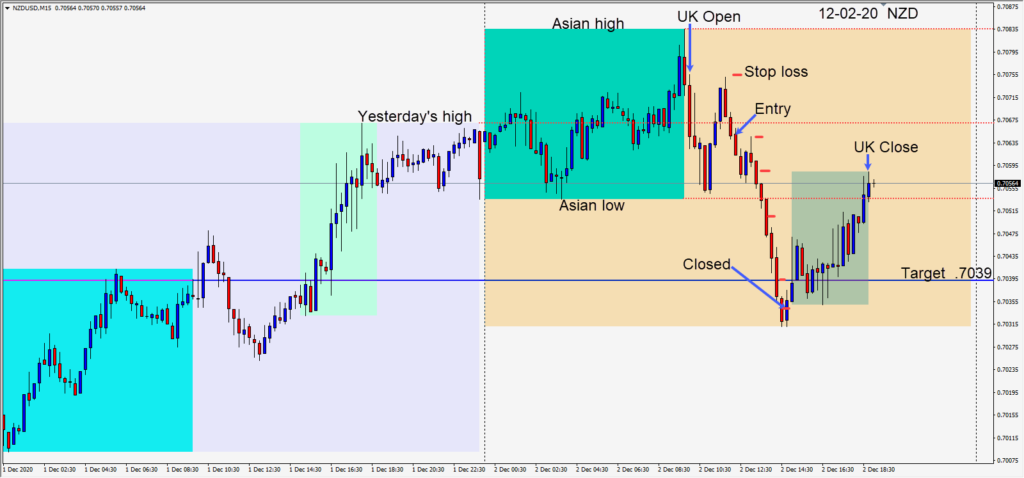

The EURUSD is also suddenly volatile at unusual times of the trading day. If you look at its movement Friday, Monday and today, someone was buying USDs and down it went each day with similar smaller moves in other majors. With the market quite short the USD, this is intriguing.

Having missed a nice setup Monday, on the GBPUSD… not wanting to start the week with a potential 30 pip loss, and missing out on a move that extended beyond 70 pips, I decided to risk 15 pips today for a potential 57 pips to our daily target at 1.3443.

Unusual activity was seen again, just after the European markets closed – up surged the GBP. We saw an instance of this type of move last week as well.

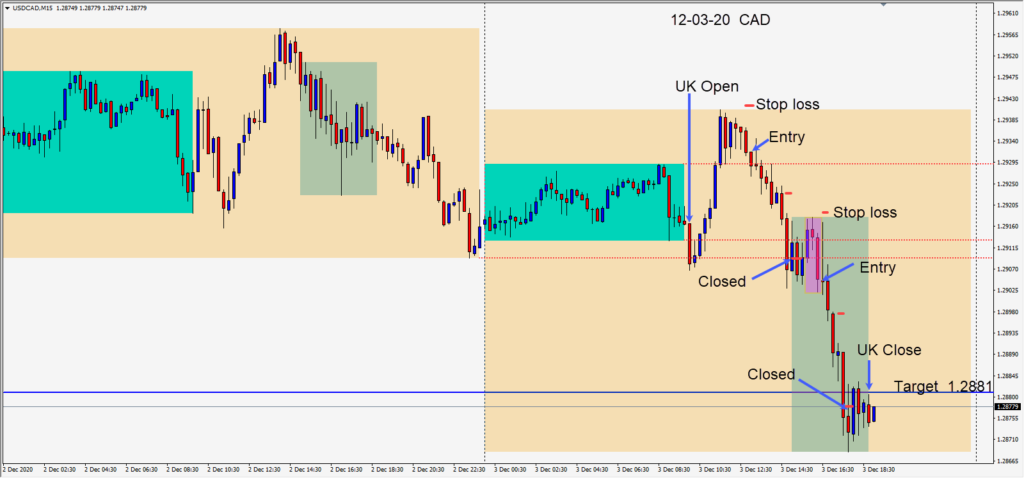

All eyes will be on the Fed tomorrow and a dovish tone could move the EURUSD over 1.22. Many seem to like the pair over 1.20 but I prefer the USDCAD short setups – especially with oil moving higher.

As the holidays approach there will be less liquidity especially near month end. Keep stops tight and be selective as always.

Good luck with your trading!