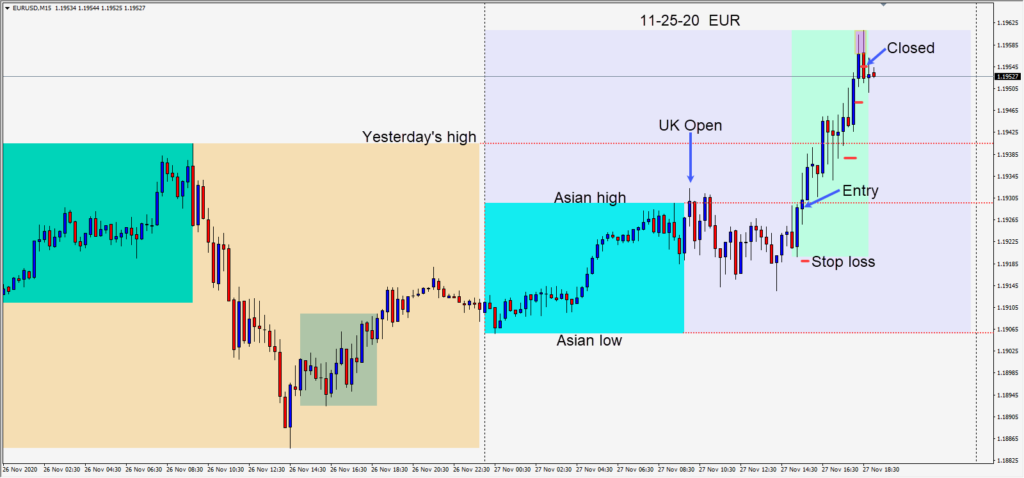

The USD has softened this week as it moves to test its September 1st low. The market has been focused on an improving global outlook for next year. Overall the market remains “risk on” in sentiment and the EURUSD closed above 1.1900 on the U.S. Thanksgiving holiday.

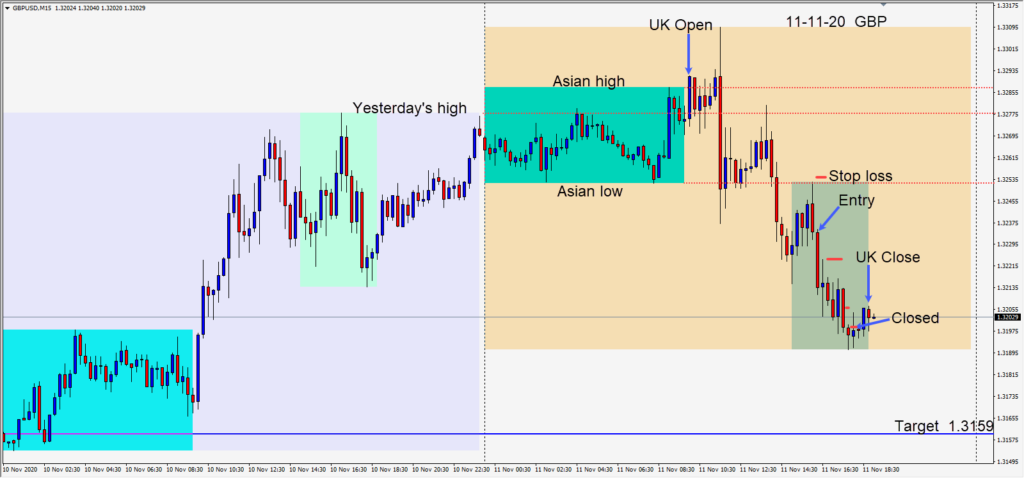

Today a long was taken risking 10 pips for a potential 40 pips to our daily target at 1.1968 (not shown).

With most U.S. traders taking Black Friday off, volume was light today.

Price had gone sideways throughout the first half of the London session but moved higher as North American trading began. Today there was no economic news releases as they had been compressed into Wednesday due to the holiday.

Price moved slowly higher – through its Asian session high and yesterday’s high where it paused and retested. Going into the European close, it extended higher and we tightened our profit stop and the trade was exited in advance of the U.K. close.

It seems like this pair has been trying to get up to 1.2000 for sometime now but has been selling heavily at the 1.1900 figure. Next week will be telling.

Be careful on Monday as month end tends to be accompanied by somewhat random moves. We will see if we get more vaccine news for a fourth Monday in a row.

Enjoy your weekend, stay healthy and good luck with your trading!