After an acrimonious presidential debate the market takeaway may be that the U.S. election outcome on November 3rd may take some additional time in order to declare a victor.

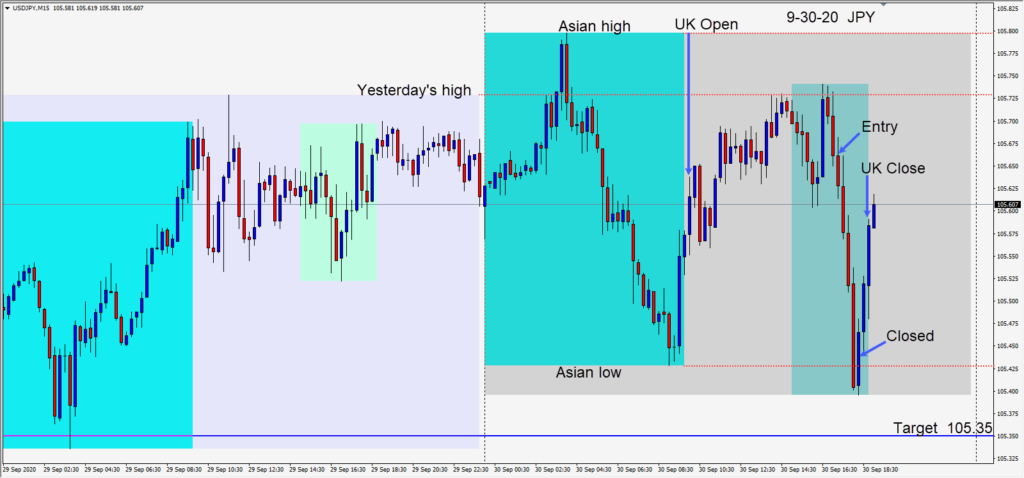

The USD initially moved higher but gave up it gains 2 hours into the U.S. session overlap. As price moved down, a short was taken in the USDJPY risking 9 pips for a potential 31 pips to our daily target at 105.35.

The USD continued to decline as the U.S. equity markets continued to rise. As price approached our daily target it rebounded after going through its Asian low and our trade was closed for modest profit.

Tomorrow begins the last quarter of a tumultuous 2020. Expect volatility as virus rates rise, Brexit talks and details linger further, and the U.S. election day nears.

Good luck with your trading!