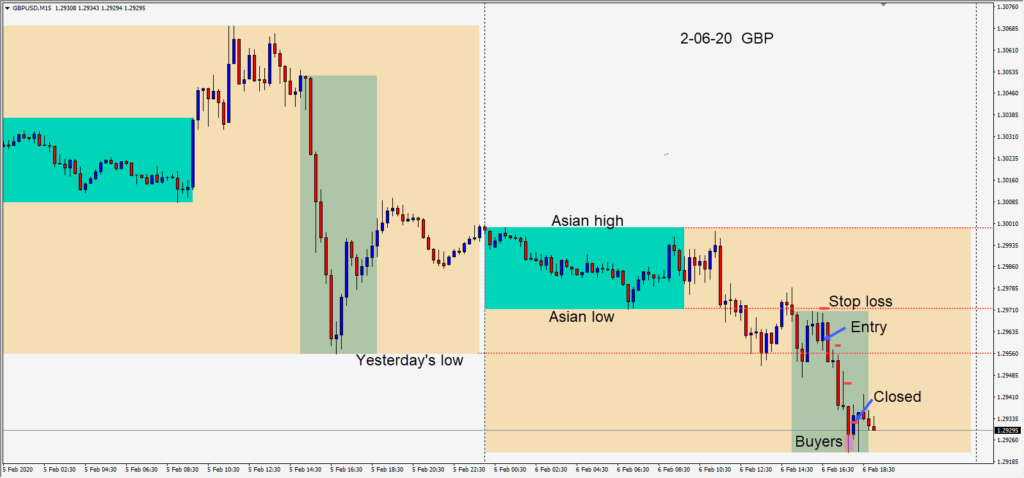

Sellers continued to emerge around 1.3000 today in the GBPUSD. A near retest of it’s Asian session high was immediately met with selling, pushing it to its Asian session low – early in the U.K. session.

After the U.S. economic releases today, price began to make another move downward and a short was taken risking 12 pips. The idea was to see if the pair could make it through the 1.2950 area and down to test 1.2900. As price moved lower, we protected profits – especially as a long lower wick appeared with a uniform move occurring across the majors at the same time.

The following candle closed our trade just above 1.2930 for an acceptable return.

Tomorrow the much awaited NFP number will be released and we will see if if the USD can close higher for a fifth consecutive day… or not.

Good luck with your trading!