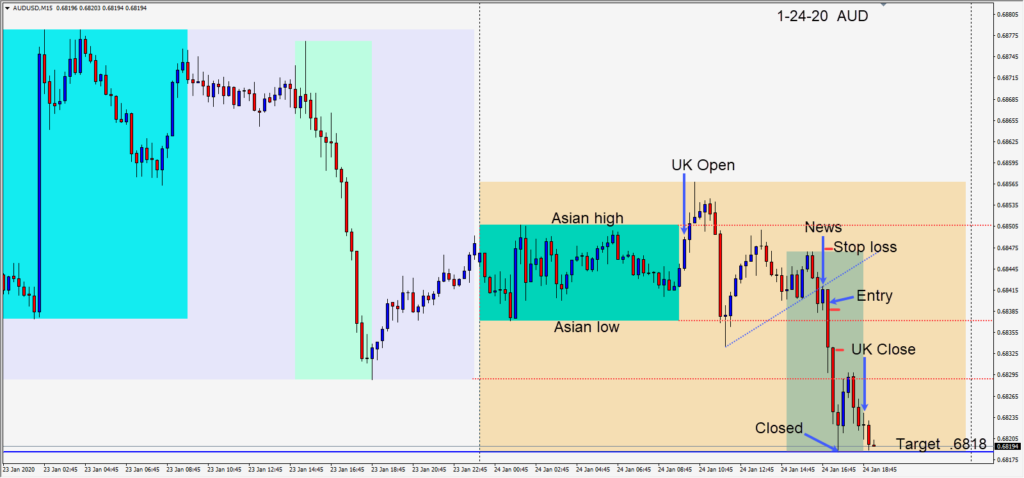

There were lots of economic news releases today. For me, the idea was to wait for them to come and go and see which way the market was going to move as a result… but not before.

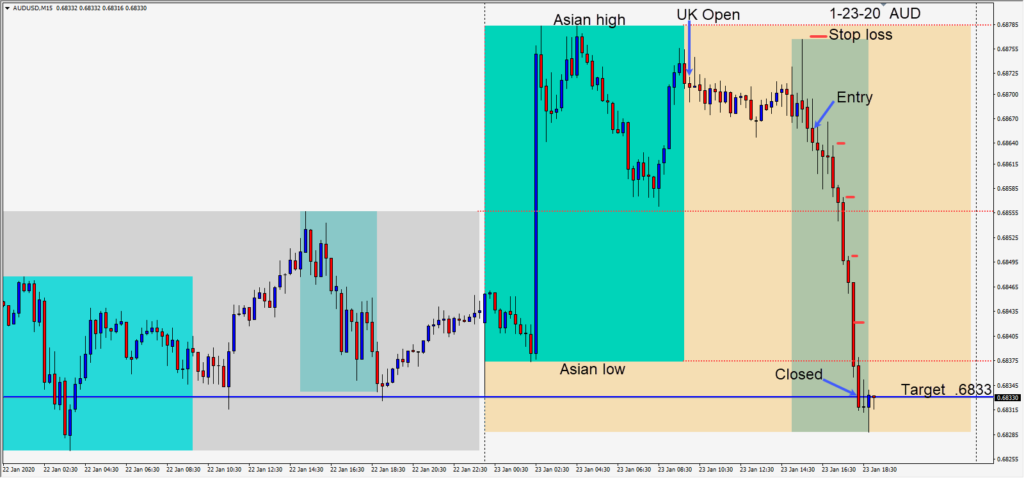

The AUDUSD was meandering up and down, then broke its simple upper trendline just before the U.S. releases. It moved up to retest the line after the news and then began to move back down.

A short was taken risking 8 pips for a potential 20 pip to our daily target at .6818. Price dropped through its Asian session low to test yesterday’s low and plunged right through it. The trade was closed at our target for a nice end to the week.

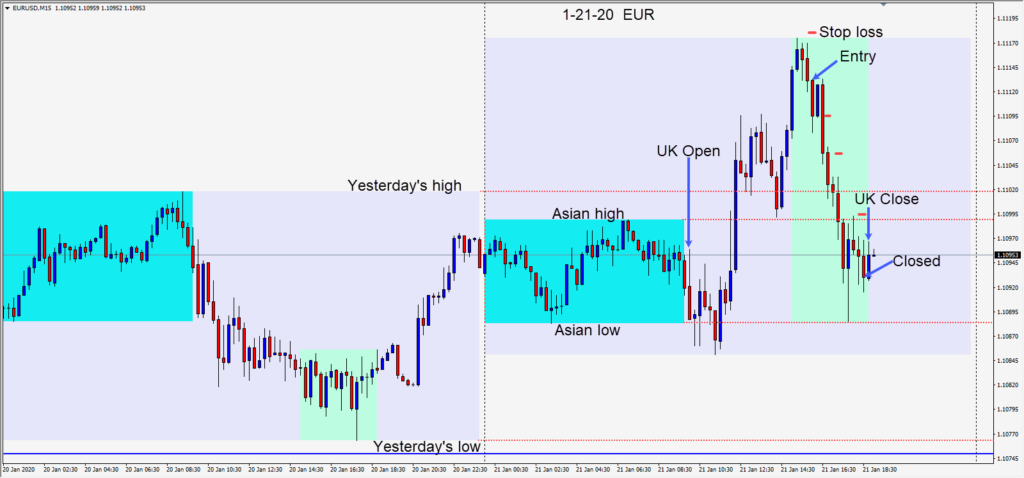

A short EURUSD at the same time netted only 4 or 5 pips…but we’ll take them.

Congratulations to Blair who nailed the AUDJPY while I was busy with the AUDUSD and EURUSD trades. I love it when former students make more pips than me – as long as they follow the rules. Well done Blair!

Good luck with your trading and enjoy your weekend!