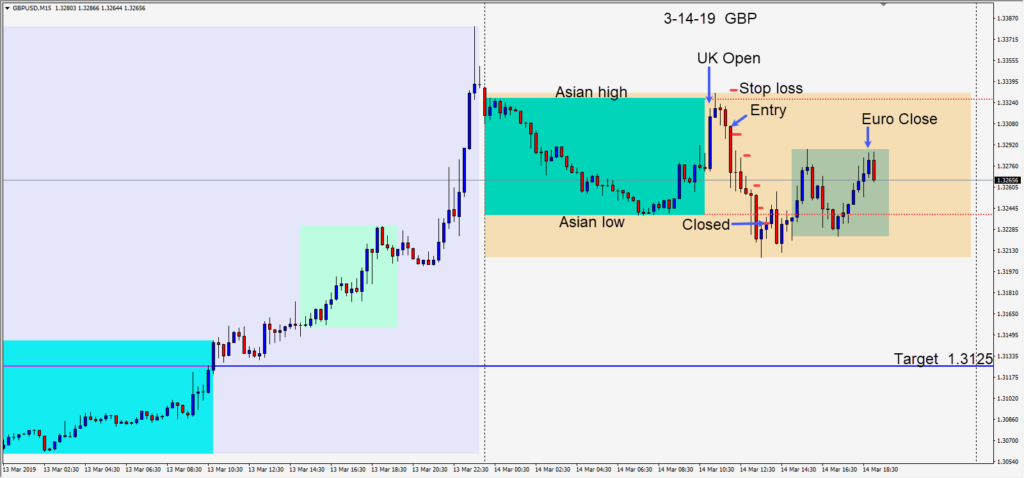

The situation in Britain continues to confound as parliament votes today to extend the deadline beyond March 29th. Even if passed by a majority in parliament, the E.U. can still say no Britain’s request. This uncertainty is keeping many traders away from the volatile GBPUSD.

As the U.K. session got underway and price attempted to rise above its Asian highs, sellers entered and price began to move lower. A short was taken risking 26 pips for a potential 182 pips to our daily target at 1.3125. Price moved lower then bounced at it’s Asian session low – leaving a long lower wick. We had removed the risk from the trade as soon as it started to move down and kept our profit stop very tight and it descended further. After a second candle left a long lower wick, we tightened our profit stop to the high of that candle… which caused the trade to be closed as price continued higher.

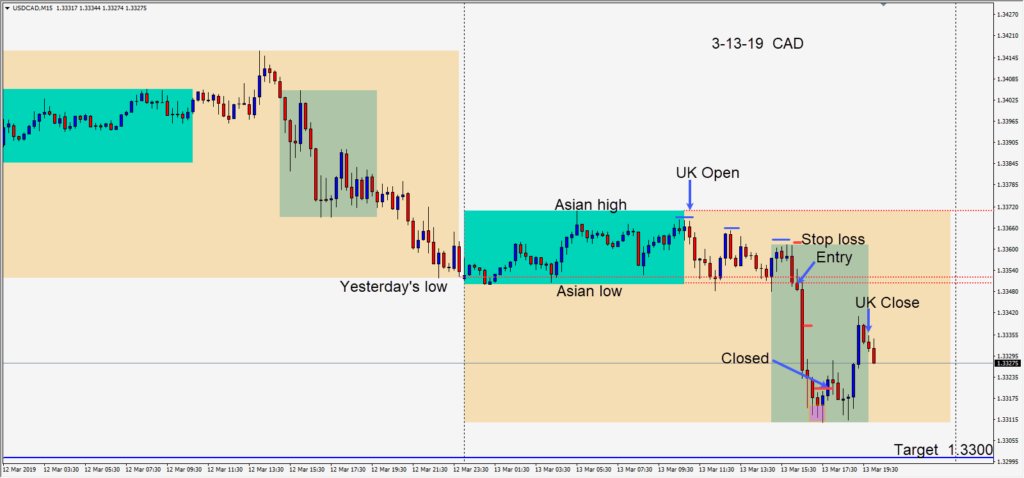

On Wednesday, before the oil inventories release, we went short the USDCAD…risking 12 pips for a potential 49 pips to our daily target at 1.3300 After a bearish engulfing candle and double-top price had moved down to its Asian session low. This level was retested before price descended quickly. A series of candles with long lower wicks began to appear in advance of the news release. We tightened our profit stop hoping for a continued move down, but our trade was closed as price moved higher after the inventories release.

The USD has been dropping since Friday’s NFP release and today is the first day that it has moved up since. The U.S. – China trade talks are looking like the negotiations may drag on into April at this stage, but remain positive.

Brexit uncertainty is not good for the GBP but a positive development could drive the pair vertically higher as many traders remain on the sidelines waiting for some sort of resolution. A negative development could drive the pair vertically down.

With the USD finally moving up today, gold gave back the $1300 level it had regained on Tuesday.

Will the USD continue to move higher from here? The market needs to digest that while the U.S. economy is slowing compared to last year, it is still very strong. U.S. interest rates are not likely to go higher this year, but the bond yields remain considerably higher than the alternatives of Europe or Japan. The German economy is potentially headed into recession and Japan is in no position to raise interest rates, nor is the U.K. The commodity currencies carry inherent risk as global growth – especially China slows down. It’s never a good idea to fight the market, but I continue to be USD bullish.