The markets have a lot to digest at the moment. The U.S. – China trade talks appear to be progressing positively and Britain is still hoping for a “soft Brexit” as the March 29th deadline gets closer and closer.

Unfortunately for British P.M. May, she is not getting the required cooperation in parliament to make the transition from the E.U. conciliatory. The drama continues to unfold and the GBP is very volatile as a result.

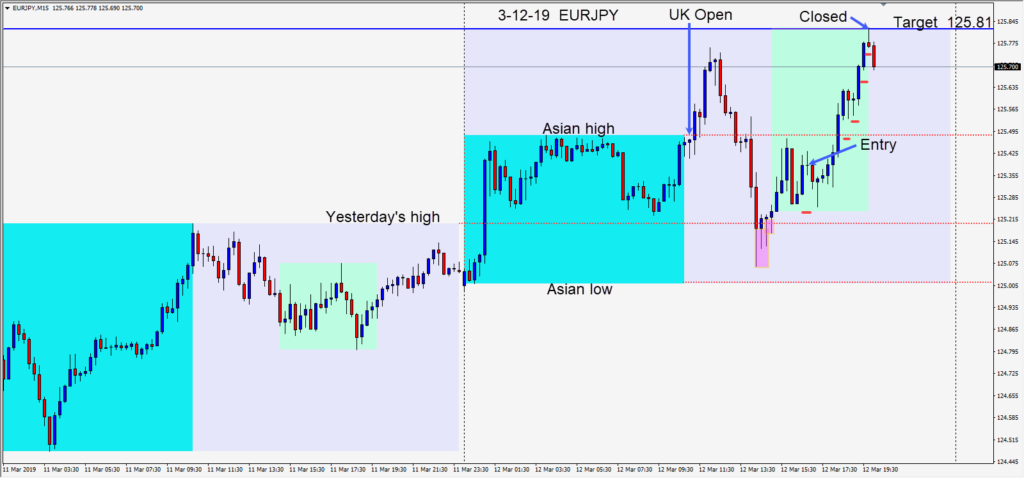

With a weaker USD again today, but no signs of panic in the markets, a long was taken on the EURJPY after it found a bottom in advance of the U.S. session and made a higher low after the U.S. core inflation release. The trade required a stop loss of 16 pips for a potential 44 pips to our daily target at 125.81. Price moved initially lower after our entry, but was able to continue higher and move through its Asian high. We continued to move our profit stop up and just before the U.K. close our target was reached.

On Monday, there were mixed signals as we started the new trading week.

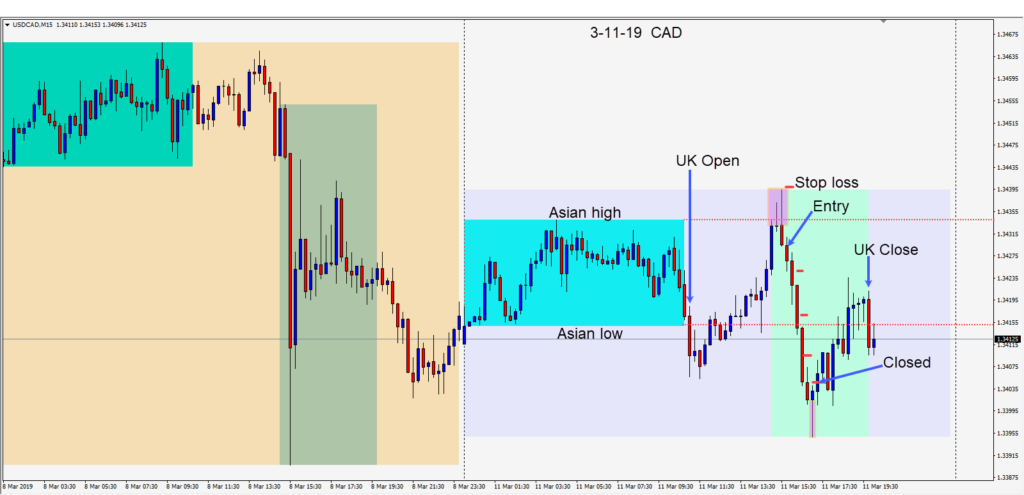

With the USD on its back foot from Friday’s NFP miss and slightly stronger oil prices…a USDCAD short was taken risking 11 pips for a potential 62 pips to our daily target at 1.3367. Price had run into sellers above its Asian session highs and began to descend. Price moved lower passing through its Asian session range until a long lower wick appeared as price found its bottom. We tightened our profit stop to the open of the previous candle and the trade was closed as a move to the upside began.

In my opinion the USD weakness the past 3 days is not an indication of a trend change. If Brexit can be worked out amicably however, there is room for the GBPUSD and EURUSD to move substantially higher very quickly. For anyone that was looking yesterday, the GBPUSD moved up about 100 pips in a few minutes early in the Asian session. This move was generated by a favourable headline about an agreement being reached between Britain and the E.U. Of course, parliament didn’t give it consent today, so there will be a new vote on Wednesday and potentially another vote on Thursday. Be extremely cautious trading either the GBP or EUR at this stage.

Good luck with your trading!