I will be returning the week of January 7th.

Archives for December 2018

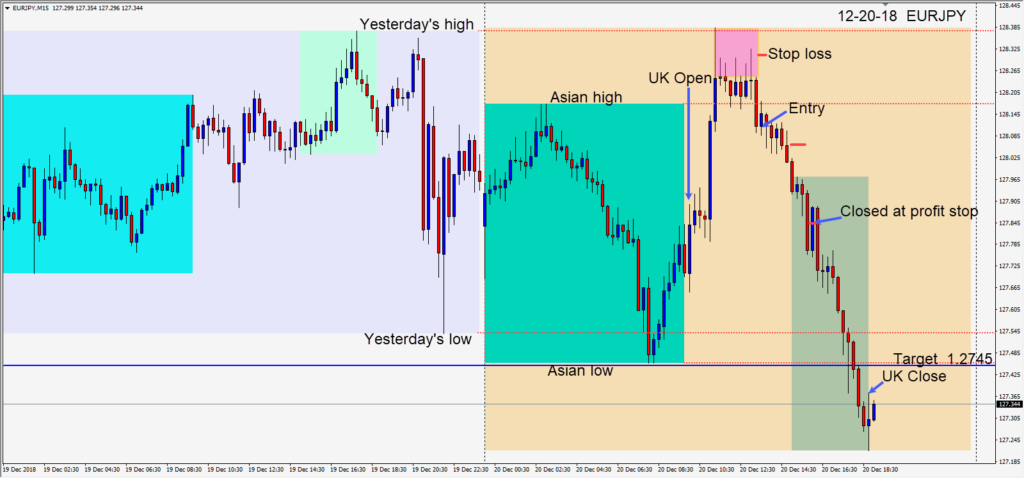

Defining risk and acceptance in a EURJPY trade

Equity markets continued to sell off and the U.S. 10 year yield continued lower today as did the USD. It was no surprise that gold moved higher and money flows were moving to the yen.

The EURJPY fell during the Asian session then retraced upward where it ran into sellers around 128.25. As it broke to the downside and closed back beneath its Asian session highs a short was taken risking 22 pips for a potential 66 pips to our daily target at 127.45.

In trading we define our risk by setting a stop loss and accepting that if the trade moves against us, and our stop loss is triggered, that is where we want to be out of the trade. By defining our risk we accept the possibility that if the market moves against us, how much of a loss we are comfortable taking. The purpose of a stop loss is to define our risk and prevent our account from potentially suffering catastrophic damage.

As price moves in our desired direction, we can take the risk out of the trade by moving our stop loss to a profitable position. Each time we move our profit stop from that point forward, we are locking in more profit. If the trade reverses and closes, then we have a profitable winning trade. From that point on whatever the market does…it does without us.

Today with the EURJPY price moved down and we took the risk out of the trade by moving our stop loss to a positive position in advance of the U.S. open. Price continued downward and we locked in more profit…accepting that if price reversed we would still have a positive winning trade. Price did reverse for one candle and closed our trade before descending to and through our daily target.

We never know in trading where the next candle will close. We have control in defining our risk when we enter a trade, and removing risk from the trade as we lock in profit. Acceptance of this concept can be useful for your trading success. It also reduces a lot of potential stress.

Good luck with your trading!

Shorting the GBPUSD as it moves lower after reaching 1.2700

After initially moving higher today, the GBPUSD failed to close above the 1.2700 figure and began to move lower. Although tempted to enter earlier… waiting for the U.S. session economic news to be released still allowed us an entry, risking 20 pips for a potential 102 pips to our daily target at 1.2572.

As price moved down, we protected our profits moving our profit stop lower. Price made a double-bottom beneath yesterday’s high and the next candle closed our trade for modest profit.

Tomorrow the major event risk will be the FOMC economic projections statement and rate increase announcement. Jerome Powell is widely expected to raise rates by 25 basis points despite President Trump’s vocal objections. Traders will be listening carefully for clues as to how healthy the U.S. economy is projected to be in 2019 and how many future rate hikes can be anticipated.

Good luck with your trading!

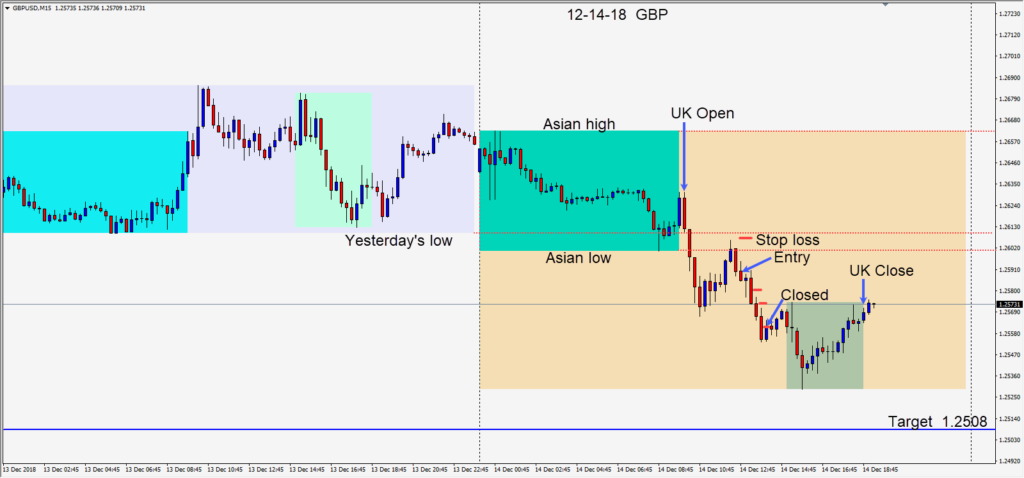

Shorting the GBPUSD to end the trading week

The GBPUSD dropped at the beginning of the U.K. session, pulled back to its Asian session lows and dropped again. A short was taken rising 18 pips for a potential 81 pips to our daily target at 1.2508. The 1.2500 figure is an area where buyers have been entering this week…so be careful near it by protecting your profits.

My preferred direction is to short this pair as Brexit issues persist coupled with British political furor. In the meantime P.M. May still has her job and will continue to negotiate Brexit with the E.U.

The markets closed the week with a “risk off” sentiment. Global equity markets closed down as did the U.S. 10 yr yield.

Good luck with your trading and enjoy your weekend!

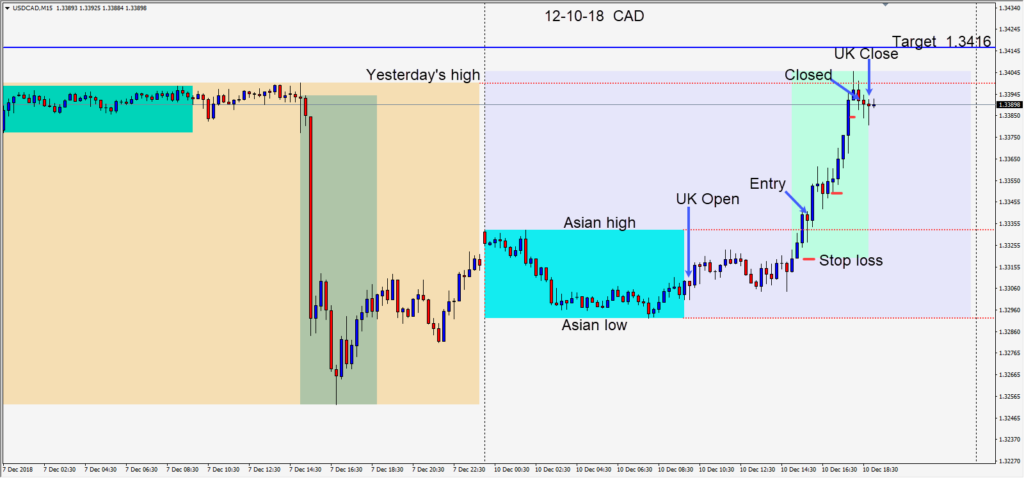

Two trades this week as the USD begins the week bid

It’s nice to see the USD moving higher as the week began.

On Monday with a very strong USD and crude oil WTI moving lower a long was taken on the USDCAD risking 22 pips for a potential 77 pips to our daily target at 1.3416. Price moved up quickly to Friday’s high and but was unable to close above and left a long upper wick. Price again failed to close higher, made a lower high and we closed the trade with 30 minutes left in the UK session.

On Tuesday, the USD was moderately stronger and after an initial move higher in the first half of the U.K. session, the EURUSD began to fade. Not wanting to enter right away as there was U.S. economic news pending, we waited as price pulled back through its Asian session high. We entered short risking 19 pips for a potential 48 pips to our daily target at 1.1320.

Price moved rapidly lower and as it touched 1.1320 our trade was closed.

The GBPUSD remains very active, but the stop losses have been too large for my comfort zone so far this week. Rumours that Teresa May’s days as the Prime Minister may be coming to an end, could cause the GBPUSD to experience a short term bounce. The pair has been finding buyers at 1.2500 this week. The negativity toward a positive Brexit outcome and where Britain will go from here if P.M. May is replaced, may cause a further move down. Markets tend to be wary of uncertainty. Be very cautious trading this pair, but my preferred direction is short when the setup presents itself.

Good luck with your trading!

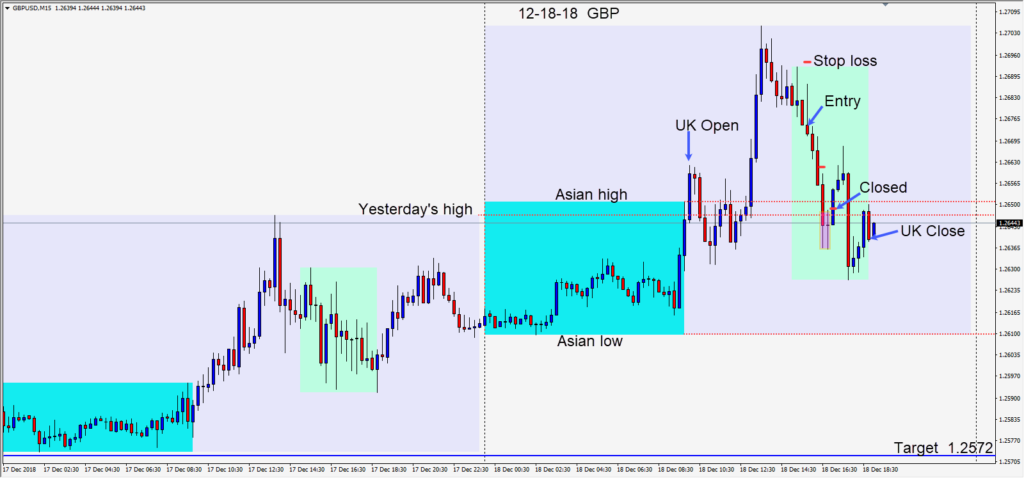

Shorting the GBPUSD after the early countertrend move higher

The GBPUSD is a very active pair lately with all the concerns surrounding Brexit. It is also potentially very volatile and is best traded with very tight stop losses. Having moved higher in a countertrend move early in the U.K. session and having made its topside range, it would likely set up for a short and a move back down… in the direction of its trend.

During the second half of the session, the pair made a lower high and an entry short was taken risking 17 pips for a potential 93 pips to our daily target at 1.2671. As price moved lower, we removed the risk from the trade and continued to lock in profit. The pair moved down with a candle closing beneath its Asian high. We allowed for a retest of this level but the bounce higher closed the trade as buyers emerged.

U.S. markets were closed today to honour former President George H.W. Bush.

The USDCAD continued higher as the Bank of Canada left interest rates unchanged today and oil prices remain about 25% off their recent highs. With talk of production cuts, it remains unclear as to when the oil producing countries will start their cuts and what President Trump will tweet if oil begins to trend upward.

Good luck with your trading!