The trade tariff rhetoric has caught the market’s attention, as anticipated – going into the holiday long weekend for North America. Equity markets were down today and money was flowing to safety.

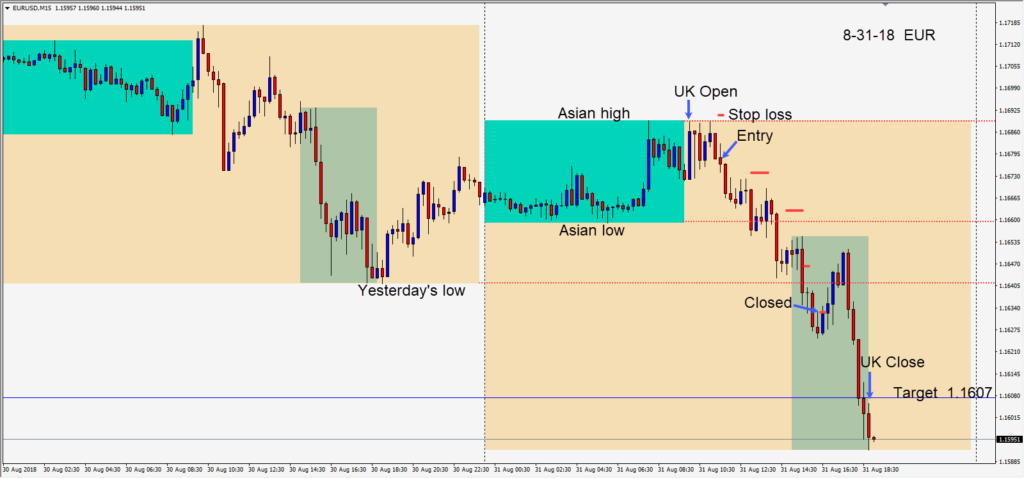

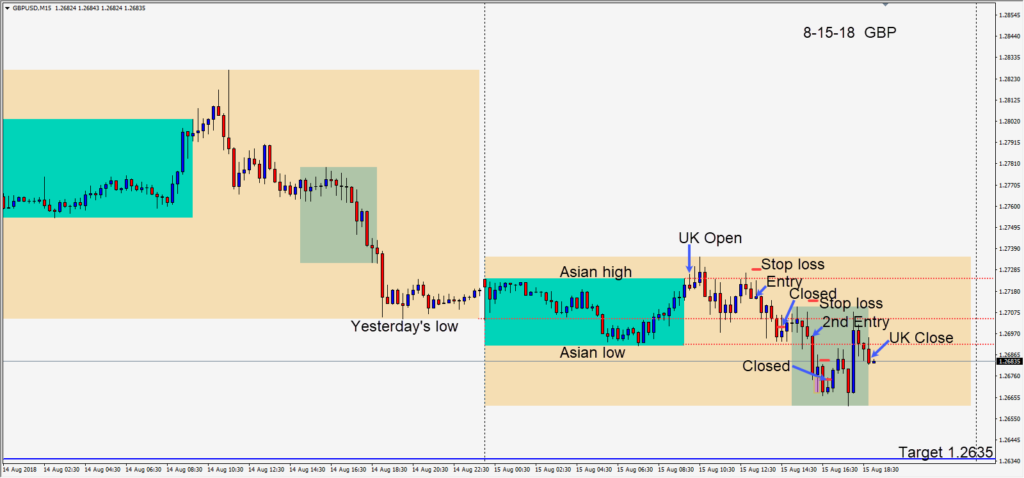

The EURUSD made a triple top early in the U.K. session and began to move down. A short was taken risking 13 pips for a potential 70 pips to our daily target at 1.1607. Price moved down to its Asian session low, retested the level and moved lower to close below yesterday’s low, but had difficulty breaking some important technical levels. We tightened our profit stop and the trade was closed. We missed the final wave down but we were spared a retracement in advance of it.

It’s unclear how the NAFTA talks will conclude today. President Trump is talking tariffs versus Europe again. Further trade tariffs with China next week may keep the market seeking safety while this gets worked out. September will not doubt be an exciting month as volumes pick up after the summer and we get closer the mid-term elections of November.

Good luck with your trading and enjoy your weekend!