Trading has been good this week with setups on multiple pairs.

There wasn’t much economic news today of significance after ECB’s Draghi spoke. Aside from Canada’s core CPI and numerous FED speakers talking the session was light on news.

The EUR and AUD continue to move down and the USDJPY continues to move up.

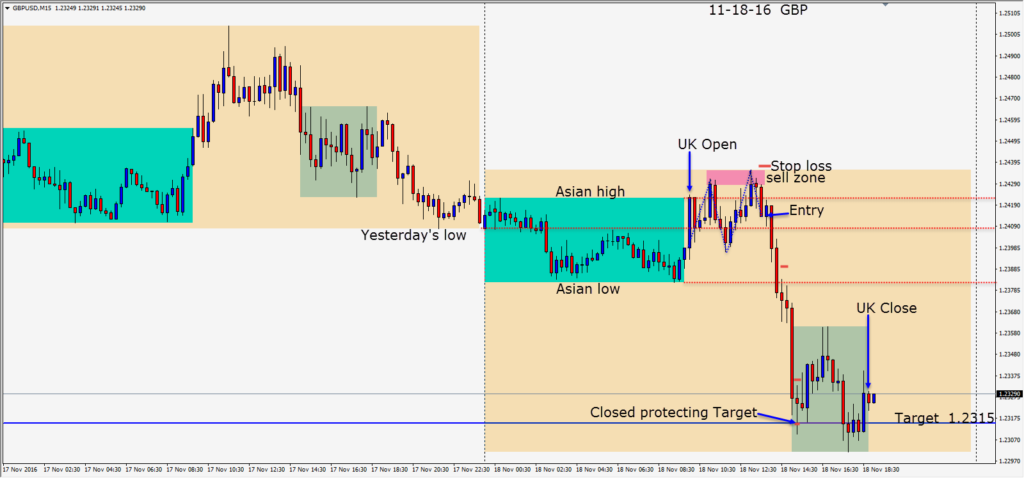

The GBP caught my eye today with the old familiar “M pattern”. The GBP currently is trading in a range between 1.2550 and 1.2150 The “M pattern” is an old favourite, but it hasn’t been as common this past year. It essentially is a move higher above the Asian high – which lures in breakout traders followed by a pullback to stop them out, followed by another false move higher and pullback. An entry short was taken after the second pullback with a stop above the session high requiring a 25 pip stop loss for a potential 97 pips to our Target*.

It didn’t take long for price to move with the trend downward. As it did, we needed to take out yesterday’s low, the Asian low and hope that the momentum would be strong enough to hit our Target. Once price moves in our direction, we eliminate the risk by moving our stop loss to a profit stop and keep adjusting it as price moves lower. Vertical moves are not sustainable, so it’s prudent to keep moving the profit stop to lock in more profit as price continues. When price hit our Target, we lock it that level, and allow price to take us out when it retraces. If price continues lower without a retracement, then we keep locking in more profit until the market takes us out.

*The Target we use is a statistical value calculated daily and it works extremely well. I used to show a Target 1 and a Target 2, but my indicator which draws it, is not working reliably after some recent MT4 updates. As a result, we are using the original indicator which I have used for years. The Target 1 is now calculated manually at 15% less than Target 2. For example if Target 2 is based on a 100 pip move today then Target 1 would be 85 pips. This calculation lets us determine our Risk/Reward Ratio.

The USD remains strong and trading accordingly in trending pairs is working very well.

Good luck with your trading and enjoy your weekend!