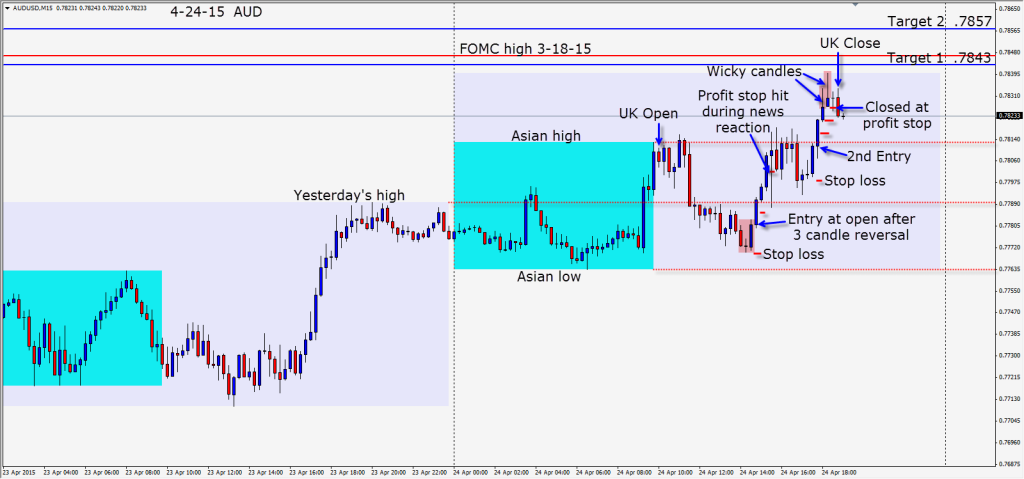

The AUD has been moving sideways in a trading range since the end of January this year. Since the March 18th FOMC day – its highs and lows have been more or less contained by the high and low of that day. In other words, it is sold near the top and bought near the bottom of the range.

Looking at a 4 hour chart, we can see that price could not close below a very important level on Tuesday that many institutional traders would be watching. On Thursday price moved above an important level for the 1 hour institutional traders. With price above both levels a counter-trend setup today after a 3 candle reversal before the opening of the US session. A stop loss is placed 12 pips below entry for a potential 76 pips of profit to our Target 2.

With the US session underway shortly and economic news pending 30 minutes after the US open… we move our stop loss to plus 3 pips quickly to remove any risk from the trade. Price continues to move up and we place a profit stop halfway down the large blue candle in advance of the news. Although the pattern is complete, the news could potentially push the pair another 50 pips in our direction or cause a reversal. As it turns out, the news volatility takes us out and we give back a few pips.

As price begins to make another move up, we enter long again and keep our stops very tight as the session only has a little more than an hour before the UK Close. When long upper wicks appear on candles… this is a sign of sellers entering. This can be considered a red flag – to tighten profit stops and lock in profits. After 2 long wicky candles, we have tightened our profit stop a bit more and are subsequently taken out by the reversal.

Although we didn’t make it to Target 1…just above T1 marked by the red line is the FOMC high – where sellers have been entering. As the wicky candles indicated… a reversal was imminent.

When trading a counter-trend trade:

1. Be very careful!

2. Ensure that the Reward to Risk makes sense and don’t expect to make as many pips as you would trading with the trend.

3. Get as much confluence as you can before you take the trade, so that you are stacking probability on your side.

4. Keep your stops tight and get the risk out of the trade as quickly as possible… then keep tightening your profit stop.

5. Be very cognizant of the levels where institutional traders are likely to add to their trending positions.

6. Read what the candles are telling you as the trade progresses.

7. Never fight the market or be greedy.

Good luck with your trading! Enjoy your weekend!

Back Tuesday if we find a trade.