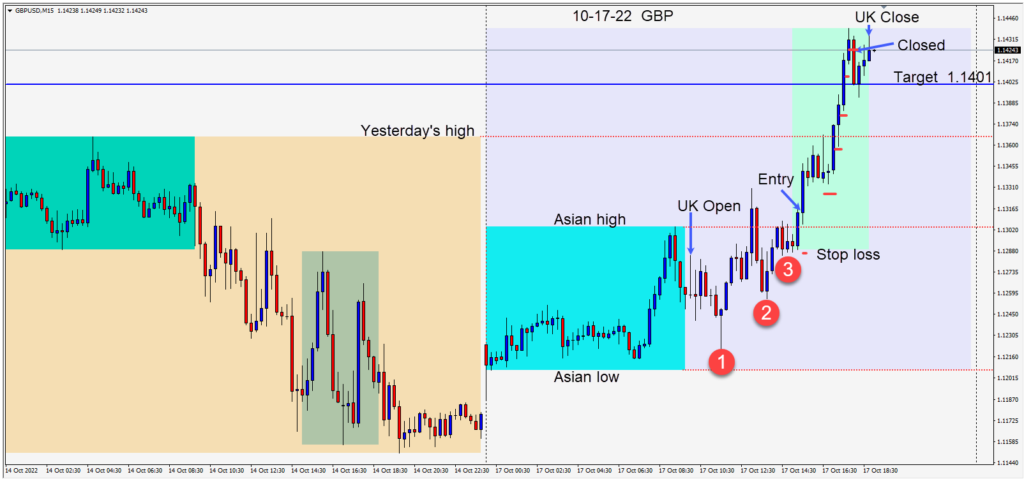

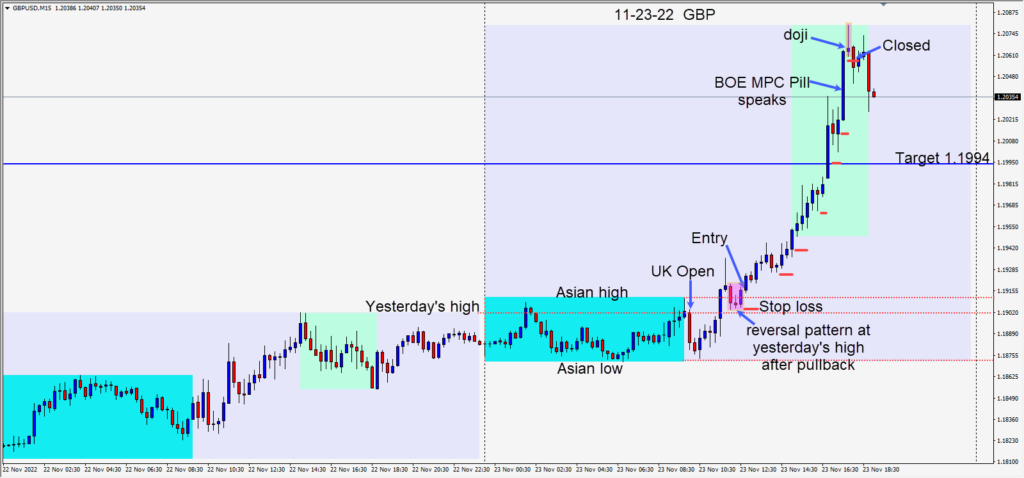

As the U.K. session got underway the GBPUSD moved lower to test its Asian session low, then broke above its Asian session high leaving a bearish doji candle. Price pulled back to test yesterday’s high before reversing higher leaving a bullish 3 candle reversal pattern.

An entry long was taken risking 15 pips for a potential 78 pips to our daily target at 1.1994. Price moved higher going into the U.S. open as the USD continued to weaken. As price approached our target, it accelerated and closed well above the 1.2000 big figure… half an hour before BOE MPC Pill was to speak. The market appeared to take his mention of a potential 50 bp U.K. interest rate hike in December as further reason to be long the GBP and it surged over 40 pips higher. The following candle was a bearish doji and we used it to tighten our profit stop which closed the trade on the subsequent candle.

If the DXY continues to move lower, the next major technical level of support is approximately 105.20.

Happy Thanksgiving holiday to Americans.

Good luck with your trading!