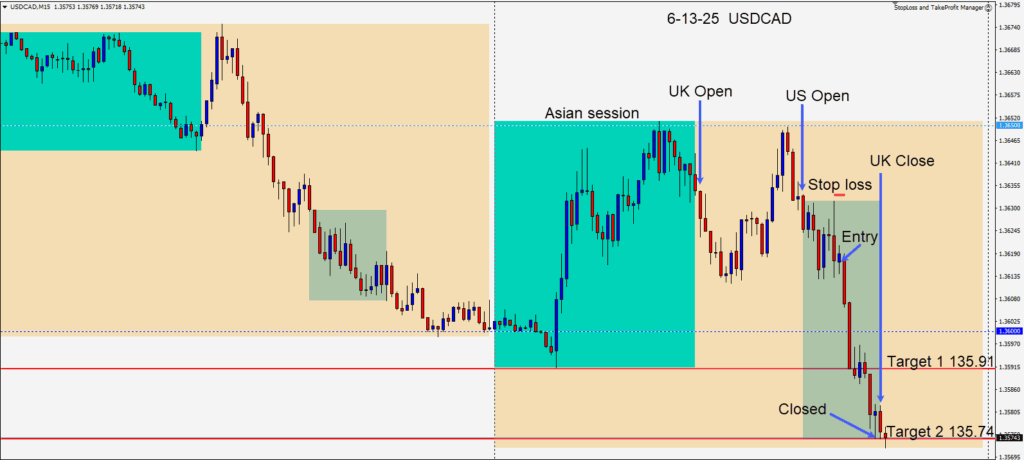

The USDCAD has been trending significantly lower. A short was taken early in the U.S. session as price began to move lower – away from a key area. Our first target was 1.3591 but 1.3574 was our main target and ultimately where the trade was closed.

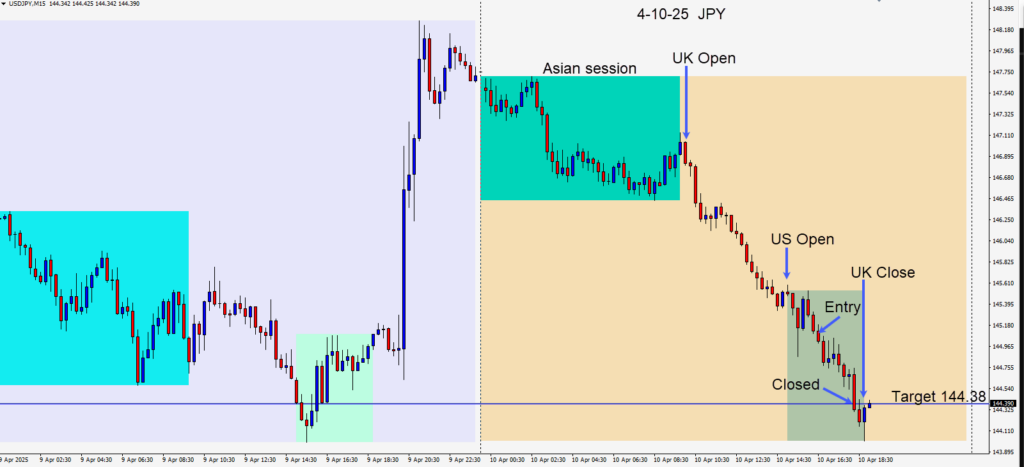

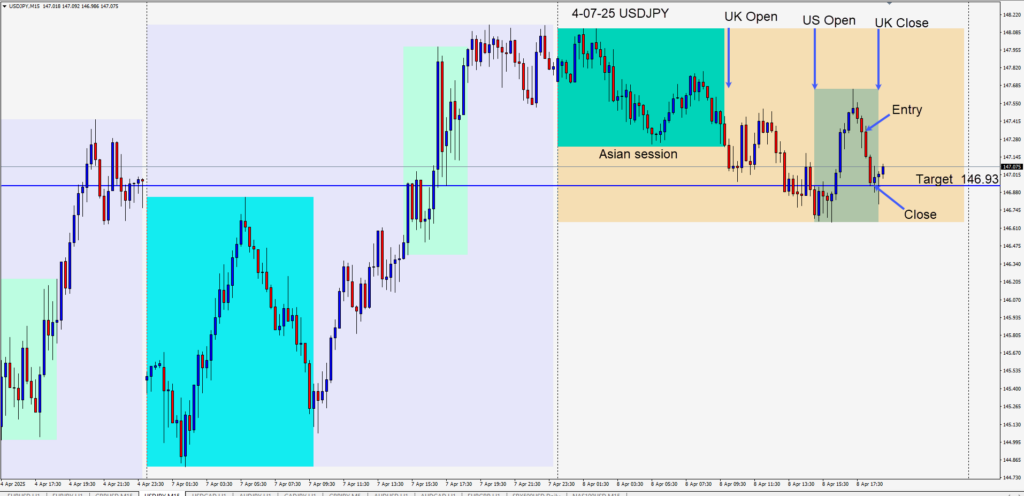

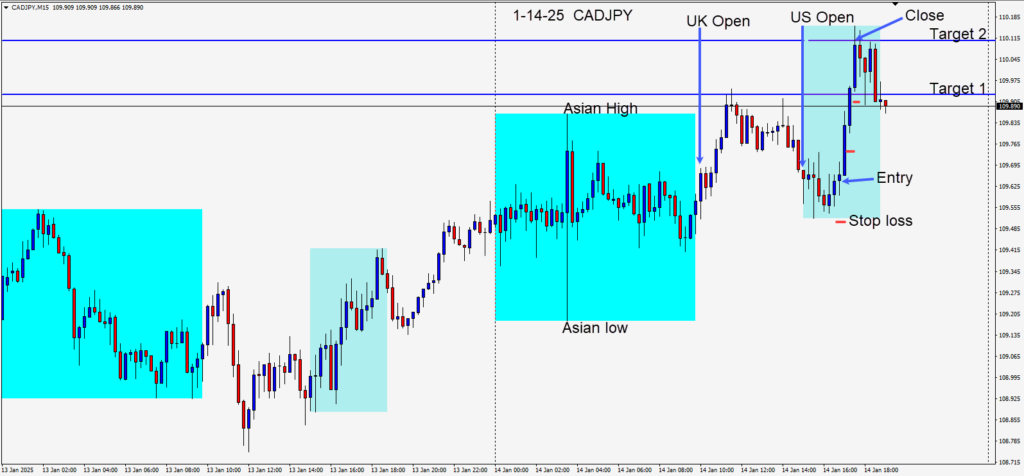

I find a lot of trading opportunities with the JPY pairs. Next week the Bank of Japan meets and despite firm inflation, the BOJ is not expected to raise rates. Significant attention will be on BOJ bond purchases which have reduced recently with an expectation of further reductions going forward.

Enjoy your weekend and good luck with your trading.